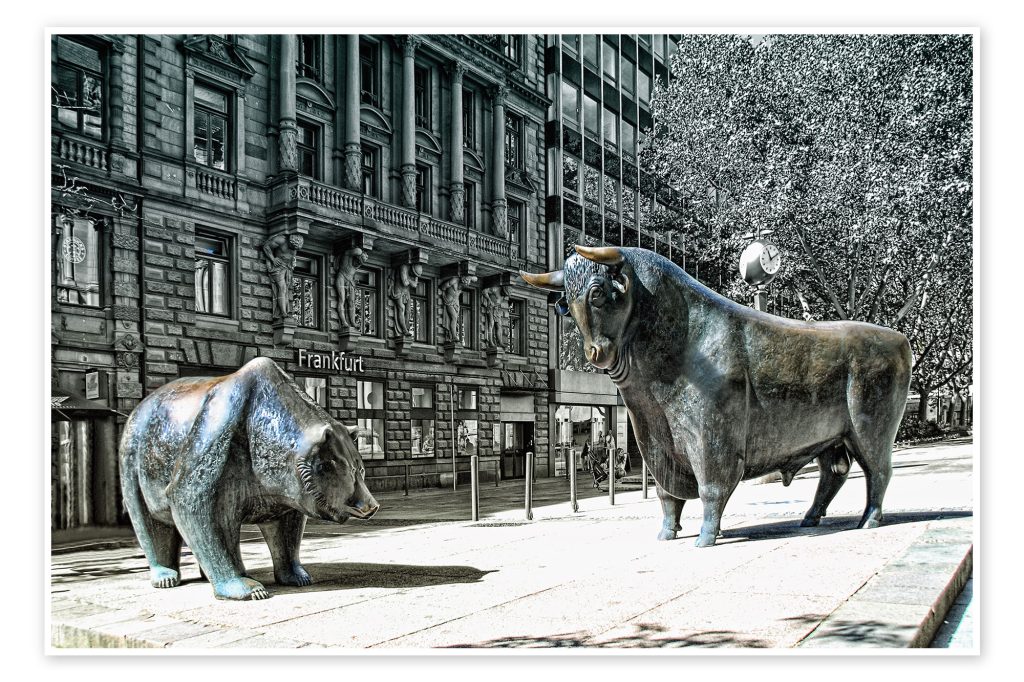

In the realm of finance, two powerful symbols reign supreme: wall street bull and bear. These icons, synonymous with Wall Street, encapsulate the ebb and flow of financial markets, embodying optimism and pessimism respectively. Let’s delve into the essence of these symbols and their significance in the world of investment.

The Bull: Symbol of Optimism

The Bull, with its imposing stature and powerful stance, symbolizes optimism and upward momentum in the stock market. Investors, buoyed by positive economic indicators and bullish sentiments, drive prices higher, fostering an environment of growth and prosperity.

Origin of the Bull

The origin of the Bull as a symbol of market optimism traces back to the 18th century when spectators observed the upward thrusting motion of a bull during attacks. This imagery translated seamlessly into the financial world, representing the upward surge of stock prices and investor confidence.

Characteristics of a Bull Market

During a Bull market, investor confidence is high, leading to increased buying activity and rising stock prices. Economic indicators such as low unemployment rates, robust GDP growth, and strong corporate earnings fuel the Bull’s momentum, attracting more investors eager to capitalize on the upward trend.

Strategies for Bull Markets

In a Bull market, investors often adopt aggressive investment strategies, seeking to maximize returns during periods of growth. Strategies such as buying and holding quality stocks, investing in sectors poised for expansion, and leveraging bullish market sentiment through options and futures trading are common tactics employed by investors.

The Bear: Symbol of Pessimism

Contrary to the Bull’s exuberance, the Bear represents pessimism and downward pressure in the financial markets. With its fierce demeanor and downward stance, the Bear symbolizes a market characterized by falling stock prices, investor uncertainty, and economic downturns.

Origin of the Bear

The Bear’s association with market pessimism can be traced back to bear-baiting, a popular spectator sport in medieval Europe where bears were pitted against dogs. The downward swiping motion of a bear’s paw during an attack mirrored the downward trajectory of stock prices during market downturns.

Characteristics of a Bear Market

In a Bear market, investor sentiment turns sour as economic indicators deteriorate, leading to widespread selling and declining asset prices. Factors such as high unemployment, sluggish GDP growth, corporate losses, and geopolitical instability contribute to the Bear’s dominance, instilling fear and uncertainty among investors.

Strategies for Bear Markets

During a Bear market, investors often adopt defensive strategies to protect their portfolios and mitigate losses. Strategies such as short selling, investing in defensive sectors like utilities and consumer staples, and holding cash or fixed-income securities provide avenues for preserving capital amidst market downturns.

Navigating Market Cycles

Understanding the dynamics of Bull and Bear markets is essential for investors to navigate the complexities of market cycles effectively. While Bull markets offer opportunities for growth and wealth accumulation, Bear markets present challenges that require resilience and adaptability to endure.

In conclusion, the wall street bull and bear stand as enduring symbols of optimism and pessimism in the financial markets, reflecting the cyclical nature of investment sentiment. By understanding the characteristics and implications of Bull and Bear markets, investors can make informed decisions to capitalize on opportunities and safeguard their wealth in an ever-evolving economic landscape.